Fastrack Redesign

Research · Visual Design

Introduction

Fastrack, a sub-brand of Titan Watches, has long been synonymous with vibrant fashion and youthful appeal in the Indian market. However, despite its strong brand presence, the Fastrack website has struggled to translate this identity into an engaging online experience.

My Role

-

Research

-

Analysis

-

Visual design

The Team

-

4 designer.

-

Titan Design head, Myself, 1 UI designer, 1 design intern.

Results

-

Reduced cart abandonment rate from 91.76% to 72.53%

-

Increased PDP visit from 30.67% to 57.4%

Overview of the redesign experience

The problem

The challenge was achieving a delicate balance between creativity and practicality, ultimately delivering an engaging experience that drives conversion while staying true to Fastrack's brand identity. How might we create an engaging online experience for Fastrack that balances creativity and practicality while staying true to its vibrant, youthful brand identity and driving conversions?

Process

We kicked off the process with a comprehensive experience review of the current experience.

The target audience of Fastrack is essentially young audience within the age group 18 to 32. So the study will be focused on this particular age demography. We decided to go with 3 methods of data collection, and 4 other methods to understand common e-commerce practices, trends and performance of the current website.

1. User Interviews

2. User Survey

3. Store Interviews

4. Web Analytics

5. Heuristic Evaluation

6. Benchmarking

7. Desk Research

Desk research (Ecommerce Practices)

None of us had prior e-commerce experience except for the Titan design head. It was crucial for all team members to grasp common e-commerce practices.

We conducted desk research to comprehend typical user behaviors and UX practices.

Key takeaways

-

Indian digital users tend to be more mobile-centric.

-

Indian consumers are price-sensitive actively look for good deals and discounts when shopping.

-

Purchases often start on mobile but finish on desktops for better experiences.

-

Shoppers prioritize gifts and essentials that cater to their loved ones over personal preferences.

-

Linking inspirational content directly to product pages can drive quick conversions.

Designing for different type of shoppers/visitors

Product-Focused shopper

-

Clearly identifying each product offering

-

Search that makes it easy to locate items of interest

-

Easy access to items previously visited or purchased

-

Checkout process to make it as quick as possible

Casual shoppers

-

Highlighting new, popular, or on-sale products

-

Pointing to new inventory through relevancy and recommendations

-

Supporting the sharing of information about products they like

-

Creating relevant, unique, and attention-grabbing product categories

Researchers

-

Providing clear and detailed product descriptions

-

Providing robust user reviews

-

Easy comparisons between products

-

Saving users’ shopping carts to allow shopping to continue

-

Including product guides and shopping assistance tools

Bargain-Hunting

-

Listing sale items alongside full priced inventory and providing an obvious section for discounted products

-

Clearly listing product prices and associated discounts and savings

-

Allowing easy coupon redemption

Personalized browsing experience

-

If executed correctly, personalization will help users feel valued and accommodated by an experience that is uniquely relevant to them

-

When personalization is executed incorrectly, users will feel annoyed by experiences that don’t match what they expect.

User interviews, survey and store manager interviews

After gaining a basic understanding of e-commerce in general, we began to delve deeper into insights specific to watch brands, Fastrack's target audience, and its competitors through surveys, interviews, and benchmarking.

Key takeaways

Watch as a status symbol

-

50% of customers consider watches as a symbol of their social status.

-

This reinforced by the branding strategies of competitors. They clearly showcases how purchasing this specific brand sets individuals apart from the crowd and help enhancing their social status.

Product Showcase - Fastrack vs Competitors

vs

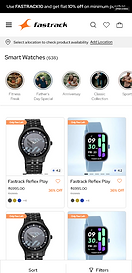

Smart Watches are the item in demand

-

Smartwatches are the best-selling product, but store managers in Kozhikode and Bangalore report frequent complaints.

-

Customers actively compare Fastrack’s smartwatches with brands like Noise, Fire-Boltt, and Boat, signaling a need for quality improvements and competitive positioning.

Smartwatch Showcase - Fastrack vs Competitors

vs

Watch as a meaningful Gift

-

30% of respondents see watches as ideal gifts, with store managers confirming that over 50% of purchases are for gifting.

-

Currently, Fastrack lacks a dedicated gifting section, with the only option being gift wrap at the checkout.

Gifts Showcase - Fastrack vs Competitors

vs

People prefer buying from Brand Website

-

70% of customers prefer buying from official brand websites, though this data may be skewed, Store managers emphasize Fastrack’s brand trust and service as key USPs.

-

These USPs should be prominently highlighted throughout the website to enhance customer confidence.

USP Showcase - Fastrack

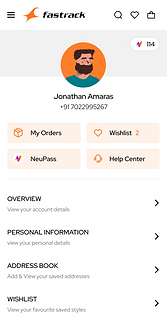

Web analytics and heuristics

In order to gain a good understanding of the current state of the Fastrack website and identify areas for improvement, data over the past six months, spanning from December 1st, 2023, to May 24th, 2024 is obtained.

This period was chosen to capture seasonal variations, trends, and any notable fluctuations in user behavior and website metrics.

Key takeaways

Despite having an impressive average time spent of 4 minutes and 11 seconds, surpassing the industry benchmark, Fastrack does not translate this into improved conversion rates or visits to Product Detail Pages (PDP).

With only 30.67% of visitors reaching the Product Detail Page (PDP) on Fastrack's website, despite an average page duration of 4 minutes and 11 seconds, this statistic raises concerns. The low PDP page visitation rate suggests potential user confusion or a lack of compelling sections to convert them into potential buyers.

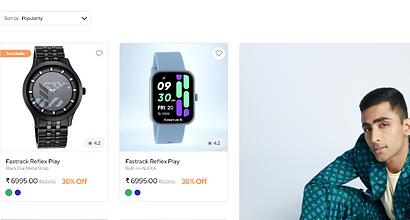

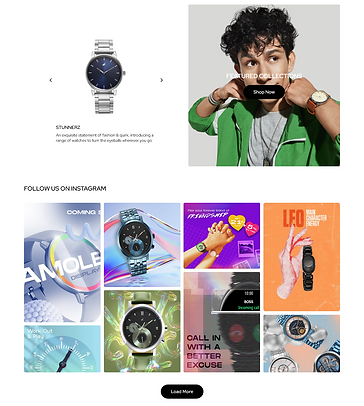

Design

After analyzing the present website and conducting thorough user research, we've formulated a series of enhancements to the Fastrack website experience. Through our ideation process, we've identified key strategies to address user confusion, enhance engagement, and better cater to the needs of our young audience. These strategies include:

Key solutions

-

Robust IA

-

Simplified product information in PLP and PDP

-

Giving more context, social proof and emotional connect

-

Prominent display of offers

-

Adjusting the entire tonality and making the website more interactive and playful matching with the target audience web behaviour.

Final Outcome : Highlights

Robust IA

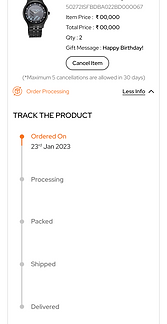

User Scenario

Only 30.67% of users reached the PDP from the homepage indicating to unclear category segmentation.

Solution

We restructured the IA with clearer category segmentation and introduced a dedicated gifting section to improve discoverability.

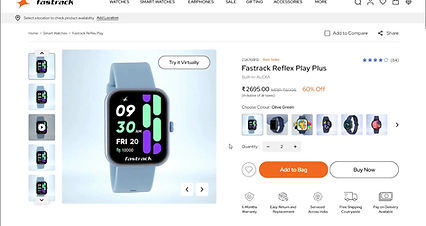

Simplified and Accurate Product Information

User Scenario

Long, complex product names and tabular descriptions made it difficult for users to understand product details.

Solution

We simplified product names to focus on the collection and one key feature. For smartwatches, we repurposed existing banners from third-party platforms to highlight key features visually, improving clarity while maintaining SEO.

Enhancing social proof

User Scenario

Users lacked trust and emotional connection with products due to limited social proof and real-life context.

Solution

We integrated customer reviews, testimonials, and user-generated content from social media on the PDP to showcase real-life experiences, building trust and credibility.

Leveraging Celebrity Influence for Better Engagement

User Scenario

Marketing relied solely on product images, missing an emotional appeal to younger audiences.

Solution

By introducing Ranveer Singh as the brand ambassador, we shifted towards lifestyle-focused campaigns with posters and video ads, making Fastrack more relatable and aspirational.

.jpg)

Building Emotional Connect Through Curated Collections

User Scenario

Users visiting for specific needs, like gifting or sports, struggled with overwhelming options and decision fatigue.

Solution

We introduced curated collections on the PLP under each category, allowing users to filter products based on occasions like "Father’s Day Gifts," making the shopping experience more relevant and seamless.

Prominent Display of Offers to Drive Conversions

User Scenario

Users often missed out on ongoing promotions, reducing purchase intent.

Solution

We strategically highlighted offers and discounts on the homepage and product pages to grab attention, encourage exploration, and boost conversions.

Enhancing Interactivity for a Playful Experience

User Scenario

Young, tech-savvy users seek a more engaging and dynamic browsing experience.

Solution

We introduced interactive, collapsible overlays and unconventional flows for features like "Product Comparison" and "Store Finder," making the website more playful and exploration-driven.

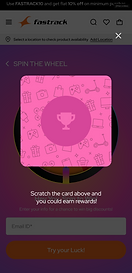

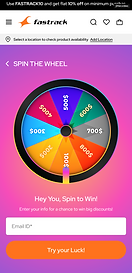

Gamifying the Shopping Experience

User Scenario

Users needed a more engaging and interactive way to explore products and stay connected with the brand.

Solution

We introduced quizzes, spin-the-wheel rewards, and guess-the-price challenges to boost engagement, enhance brand loyalty, and create a fun shopping experience.

More screens and highlights

Results

From here onwards, the Titan team assumed responsibility for testing and development, while maintaining constant communication with us throughout the process. Although our involvement was primarily in support tasks, the collaborative effort culminated in the release of the website's first phase on December 27th, 2023.

As testing continues and remaining features are integrated, the project progresses towards completion. Encouragingly, on April 1st, the Titan team shared positive KPIs indicating significant improvements

-

Reduced cart abandonment rate from 91.76% to 72.53%

-

Increased PDP visits from the homepage from 30.67% to 57.4%

These positive outcomes reflect our joint efforts in enhancing Fastrack's online presence and driving user engagement.